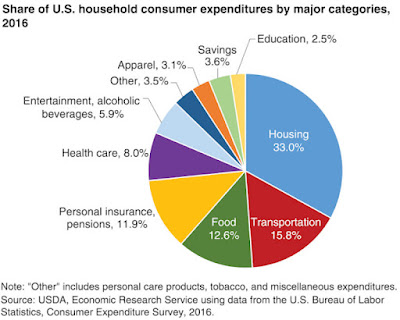

It's one of the biggest challenges in personal finance. The good news is that there are always ways to save money. Some ways are just better than others. But instead of saving a couple of dollars, you really should concentrate on where it really matters. To actually save money each month, you need to figure out your biggest expenses. Just take a look at the chart.

You don't want to end up saving almost nothing after spending countless hours. That's why you need to target your biggest expenses such as housing, transportation, food, and insurance. You can use budgeting tools like

Trim,

Personal Capital,

Money Dashboard (UK) or

Moneyhub to track your monthly expenses . Focus on smaller expenses after you've gone through and executed the following tips one by one first.

1. Save first, spend after

This one's a really simple but yet so powerful advice. First of all, we tend to put more weight on our immediate needs than those in the future. For example, you might want to buy a house someday but end up spending on travel, fancy clothes or a new car. Nowadays we are also using credit cards instead of cash. Paying with cash is more painful and credit cards separate us from that unpleasant feeling. Finally, we tend to act on impulse. After making the purchase we are justifying it by saying things like "it was cheap" or "it was on sale".

The solution to our money spending habits is quite simple. Most banks allow you to do automated money transfers from your account on a regular, periodic basis. Just choose the amount of money you want to put away monthly and transfer it to a savings account on your payday. This way it's much harder to access that money and you'll certainly save money from your salary. You can spend the rest of your money without feeling any guilt.

2. Housing costs

Purchasing a house

Purchasing a house or apartment is a major decision when it comes to your personal finance. Your mortgage is going to eat a huge portion of your monthly income. That's why you should keep in mind, that no matter which country you're from, banks and other mortgage lenders want to approve for the largest mortgage possible.

- Just because you're approved for the maximum amount of mortgage, it doesn't mean you can afford it or should take that much loan. A downtown apartment sounds tempting but it may not be a wise choice when it comes to your personal finance.

- Buy a right size house/apartment. You most likely won't need that extra space. Extra space means extra costs for you.

There's no right answer to how much you should take loan but you should consider your total expenses, not just the mortgage. Remember that you're paying your mortgage for 10-30 years. Someday you may also have kids or a car. After you've found a suitable house or apartment, it's time to negotiate your interest rate and other cost related terms. You're wrong, if you're thinking that tendering out your mortgage isn't worth it.

- For example a 0,25 % difference in your interest rate can impact of a 150.000 USD mortgage by 17 USD/month. That's 204 USD/year and using a 20-year loan it's 4.080 USD in total. The difference is 10.800 USD if you use a 20-year 200.000 USD mortgage.

Of course, there are other costs than just the interest rate that a mortgage lender is charging you, but understanding the compounding impact of your interest rate and other costs is crucial when choosing the best mortgage lender for you.

Choosing your mortgage can mean a lot of phone calls, e-mails, and forms to fill. I suggest you sign up to

LendingTree (US),

LoanConnect (CAN) or

Mortgage Simplicity (UK) and get quotations that you can bring to your favorite mortgage lenders. They're most likely going give you better rates than you got from LendingTree / LoanConnect / Mortgage Simplicity. If not, they are matching your rates. After you've got your new offers, just compare the loan details and decide which lender is the best.

Refinance your loan(s)

Refinancing means that you're replacing your existing mortgage with another. The previous example shows that refinancing your loan might be a money saver for you. While lending restrictions have tightened, you may get good rates if:

- You can negotiate a better interest rate (=lower monthly payments). Shopping around is the best way to find out if lower interest rates are available.

- You can renegotiate terms that are causing you (unnecessary) risk. For example, you could switch from a variable interest rate to a fixed interest rate.

- You reduce your monthly payment but it usually means a longer loan period. For example, you could switch a 20-year loan to a 30-year loan if you have a better use for that money. On the other hand, you end up paying more interest and pay your loan longer.

- You combine your existing loans into one loan.

First, you should compare your current loan and interests paid so far and your possible new refinanced loan so you can figure out your options. Once you know your options, you can try to reduce your loan term and interest rate in order to get your long-term borrowing costs down. But before you do that, you need to know your numbers. At this point, you can make some calculations about possible scenarios by using free refinance calculators you can find on the internet.

After you have everything figured out, approach the mortgage lenders one by one or just use

LendingTree (US),

LoanConnect (CAN) or

Mortgage Simplicity (UK). I've done a similar thing and got my mortgage rate down 0,3 %.

Rent

The amount you spend on rent can have a big impact on how much you can save from your paycheck. These tips help you to save money:

- Do you live in an expensive area? If so, you should consider if it's really worth it. Moving to a cheaper area can save a small fortune for you. You don't have to move to a low-cost city but you should at least consider moving a little further away from the popular neighborhood.

- Be flexible. In other words you should overlook things like ugly carpets. They will have very little impact on your life.

- Look for rental apartments that have been on the market some time (and negotiate your rent).

- Get a roommate or two. If you sacrifise some privacy, you can live at almost half the cost of what you would pay if you were living alone. If possible, try to sign separate leases.

- Take a look at your overal costs. For example, some places include water in the rent, while others don't.

- Negotiate your rent. You can offer several things in exchange for a lower rent: 1) an extended lease or termination notice 2) give up your parking space 3) pay several months rent in advance.

3. Groceries

Going out to eat is expensive so you should avoid doing it too often. It's much cheaper to prepare your own meals. You can also look for clothes that are on sale or out of season. Here's how to save some money:

- Use a shopping list and stick to it when doing groceries. This way you can avoid making impulse buys.

- Shop discounted clothes online: Amazon and Ebay are your obvious choices but you may also want to try secondhand/thrift stores such as Schoola (children clothes) or ThredUP.

- Take advantage of cash back reward cards and sites such as Rebate, TopCashBack, Target RedCard or Costco Visa etc.

- Buy store brands instead of name brands. The only difference between them is usually advertising. You'll realize that store brands are just as good.

- Prepare your own meals. Trust me, it's not that hard and homemade meals are much healthier than take-out food. Buy a cooking book or try budget friendly meal plans: $5 Meal Plans (US), MyFreezEasy (US) or HelloFresh (EU).

Keep also in mind that your health is just as important as keeping your grocery bills in control. Eating healthy can help you sleep better, boost your immune system, lose weight and lower your blood pressure and cholesterol. Not only will this save you money you would normally spend on medicines and treatment but you won't lose productive time being sick.

4. Transportation

Car

Cars drop in value every year and we can't drive a car without insurance, maintenance, gas, and taxes. That's why it's really easy to argue that cars destroy your personal finances and they're bad investments. So if you're thinking about buying a car or you already own one, you should take a look at the following advice:

- Keep your car for a long time. The average montly payment on a new car is 500 USD/month, so keeping your old car saves you a lot of money.

- Buy a fuel-effiecient car. It saves you a lot of money in the long term.

- Buy a used car. You should look for cars in relatively good condition.

Public transportation

If you have an easy access to the transit system, you should use that option instead of your car. Public transportation is cheaper and you don't have to pay for parking. In most cities you can also buy an annual transit pass (I'm having one too) which is much cheaper compared to a car.

5. Insurance

We're all needing insurance to protect ourselves from financial loss but you need to make sure that you're not paying too much. Checking them on a regular basis could yield you nice savings. That's why shopping around for your insurance or rendering out your existing one can be worth it.

- Make sure you're not overinsured or underinsured. You're obviously paying too much if you're overinsured. On the other hand, being underinsured can cost you if the unthinkable happens.

- Do your homework to make sure that you found a good deal. Get quotes and compare them.

- Cut out the middleman (=agent). Insurers such as Geico go directly to consumers without using a agent. They can be the most affordable option.

- Raise your deductible. A higher deductible means lower liabilities for the insurer. Therefore raising your deductibles can lead to lower insurance costs. That's why you should consider raising your deductibles.

- Use only one insurer. Especially large insurers offer you discounts if you use them to cover multiple insurance policies or multiple houses or cars etc.

There's a lot of different insurance types and choosing the right one can be time consuming. The good news is that you don't necessarily have to contact insurance companies one by one. There are services that helps you get multiple quotes at once: Esurance (car insurance), Policygenius (Life Insurance). Just keep in mind that you should carefully read the insurance policies and make sure that the policies are right for your needs. If you're uncertain, you can always look for more information or talk to a insurance agent.

Summary

Hope these tips will help you to figure out how to save money each month. Now I'd like to hear from you. Do you know a great way to save money? Share us via comment.

And if you liked this page, please share it on your social media site.